Take Your Portfolio to New Heights

The Power of Commercial Real Estate

Benefits of Real Estate Investing

Cash Flow

Inflation Protection

Diversification

Pursuing smart investment alternatives

Forward-thinking investors deserve smart alternatives outside the volatility of the stock market and public exchanges. Real estate may provide a solution.

MORE THAN JUST DIVERSIFICATION

APPRECIATION AND INCOME

Commercial Real Estate Property Types

- Multifamily

- Retail

- Office

- Industrial

- Other

Description

Residential buildings vary by location (urban or suburban) and may be further classified by structure: high-rise, mid-rise, or garden-style.

Advantages & Disadvantages

Economic drivers include demographic trends, home ownership, household formation rates, and local employment growth. Leases are typically short-term and adjust quickly to market conditions. Generally considered to be one of the more defensive investment types within commercial real estate, though they are still subject to competitive pressures from newer construction.

Description

Everything from small shopping centres, strip malls, and outlets to large power centres with a “category-dominating” anchor tenant.

Advantages & Disadvantages

Most broadly influenced by the state of the national economy generally, especially such indicators as employment growth and consumer confidence levels. More local factors include the property location and its traffic flow; population demographics; and local household incomes and buying patterns. Leases also often have long terms, which means that after a while lease rates may lag current market rates, and step ups may need to wait until lease expirations.

Description

Range from high-rise multi-tenant structures in city business districts to mid-rise single-tenant buildings in suburban areas.

Advantages & Disadvantages

Rents and valuations are influenced by employment growth and a region’s economic focus. Individualized tenant improvements are usually not very involved, but credit quality of tenants is key; re-leases of office space typically require some lead time to consummate. Office properties often have longer-term leases that can lag behind current market lease rates, so that significant “step-ups” or “step-downs” of rental rates may occur when leases expire.

Description

Manufacturing facilities, warehouse and distribution centres, research & development (R&D) properties and flex-space.

Advantages & Disadvantages

Manufacturing and R&D properties tend to be build-to-suit buildings that can be difficult to “re-tenant” without extensive modifications, while warehouses and distribution centres can be more generic buildings. Industrial properties are also influenced less by local job growth than by larger economic drivers such as global trade growth (imports and exports) and corporate inventory levels. As with office buildings and retail centres, industrial property leases tend to have long terms, so that over time lease rates can fall behind the “market.”

Description

Self-storage facilities, mobile home parks, student housing and hospitality.

Advantages & Disadvantages

Key drivers include demographic trends, the state of the national economy in general, and large macroeconomic drivers such as supply/demand.

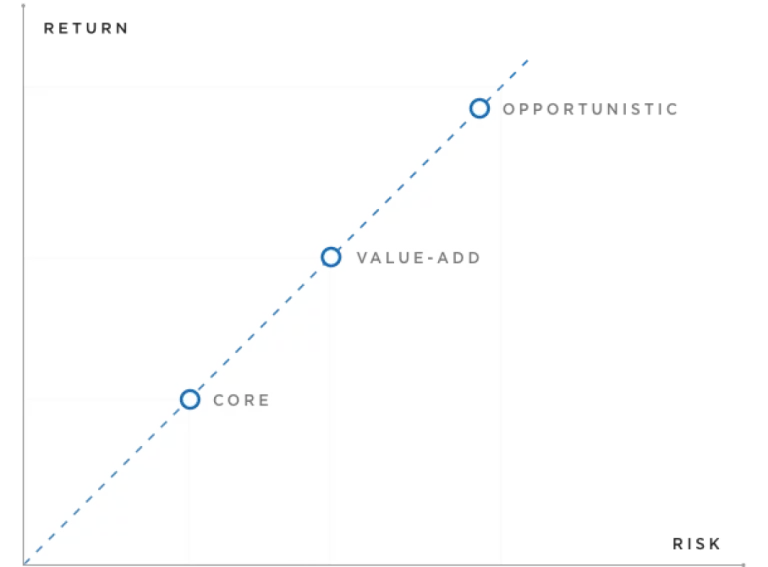

Balancing risk and return

A well-balanced commercial real estate portfolio may include some or even all of these different investment strategies.

Investment Strategies

Each of the three primary categories of real estate investment strategies has its own risk and return characteristics.